The portfolio of Vitkovice Machinery Trade (VMT) includes not only Duro Dakovic, but all of the "big five" wagon manufacturers. This tolling company managed to stabilise the production and especially the sales of the leading European manufacturer of so-called "thick plates" - Vitkovice Steel. Since then, VMT has expanded not only in the railway markets, but is also beginning to penetrate the logistics and energy sectors. We asked VMT's CEO Tomas Mischinger what the company has been dealing with most during this time.

RM: How long and complicated was the journey from the time when Tolling entered Vitkovice Steel to convincing your existing customers that you are a serious supplier who meets all deadlines and contracts without any problems?

Tomas Mischinger: Well, it wasn't easy. The customers were not cool, to put it politely. Not surprisingly, these are mostly customers with thousands of tonnes of plate in stock. Consider that in April 2022, due to the conflict in Ukraine, the price went up by more than 50% to €1,800/tonne and then started to fall rapidly, say by €100/month. They needed to get this expensive material as soon as possible, but we were all facing the opposite. What was important was the face-to-face meetings, the understanding that this was an exceptional situation where we had to stick together and act in a businesslike way. To breathe it out, to believe that it will get better and that it can be done. We assured them that Vítkovice Steel, with us as a strong tooling partner, if you want a financial operator, would quickly manage the situation and stabilise and then develop the supply.

RM: What did you convince them of the most?

Tomas Mischinger: Of what? Well, fast reality, nothing else could convince them. The meetings took place in the summer of 2022, and by the end of the year we were over the worst of it, back to being reliable on deadlines, stabilising our supplier portfolio. You know, the worst thing would have been foot-dragging, inaction, non-communication. VMT, with its support and approach, did the opposite, poured clean wine for the customers and outlined a plan to get the situation under control quickly. And it worked.

RM: What does a tolling company like yours actually do - how can it help companies?

Tomas Mischinger: VMT is a tooling company and also part of a healthy industrial holding, CE Industries. They have 20 companies, two and a half thousand employees and a turnover of over 320 million euros. We seize the opportunities of the present with an eye to the future. We develop, support and capitalise. But be careful, VMT is not just a financial operator. We want to and enjoy developing the business, and that's what we are trying to do in the case of our partnership with Vítkovice Steel.

RM: So-called thick plates are currently mainly supplied to railway manufacturers. What other sectors and regions are you targeting?

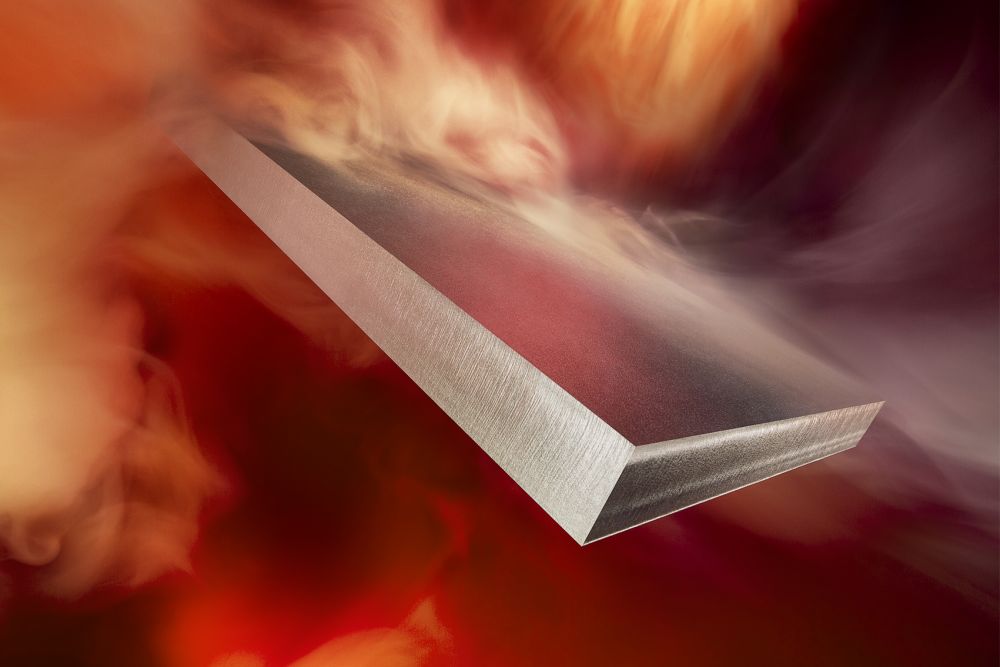

Tomas Mischinger: Well, that's the thing. Once we had financially stabilised the supply of raw materials and the general operation of the company, we started to look at the customer relationships, to listen to them and to identify the challenges and opportunities. Apart from the railway segment, heavy plate has applications in the marine segment, wind farms are built on piles of our plate, bridges are made of heavy plate. Some fabricators are more interested in consignment stock options, others want fast production, others want good communication, and all want good price and quality. The plates from Vítkovice are of high quality, they have a good sound and VMT adds to the comfort of the customer.

RM: Where do you see the future of heavy industry in 10 years' time? Fit for 55 is talking about a 55% reduction in emissions by 2030. How will that affect your industry?

Tomas Mischinger: The decarbonisation of the steel industry is a big issue. On the one hand, we all want to breathe cleaner air; on the other hand, we can't do without steel yet. The world produces over 1.8 billion tonnes of steel a year, of which about 0.5 billion tonnes is produced from scrap in electric furnaces. So most of the 1.3 billion tonnes is made from iron that is conventionally produced from iron ore in blast furnaces. However, this process produces CO2 through chemical reactions that exploit the properties of coke. The production of one tonne of steel produces about 2 tonnes of CO2. In the Czech Republic, CO2 emissions from steel production account for about 5% of greenhouse gas emissions, the highest of any manufacturing industry.

Up to this point, efforts to reduce them are understandable. Worse is the speed expected by the EU.

RM: Yes, the target is to reduce greenhouse gas emissions by at least 55% by 2030. The question is how?

Tomas Mischinger: The alternative to making steel in blast furnaces is direct reduction of iron ore (DRI) with natural gas or hydrogen. But the consumption of these fuels is enormous. It costs around €400 million to build a DRI plant with a capacity of 1 million tonnes of iron. If you want to make such an investment, despite the infinite returns, you have to take into account depreciation, emission rights and the price of steel, and there is no cheap source of natural gas in Europe, while producing the required amount of hydrogen requires a large amount of electricity and natural gas. To give you an idea, if, for example, the Czech steel industry (5 million t/y) were to switch completely to hydrogen reduction, it would need about 10 times more energy than today, i.e. about 20 TWh, which is a quarter of the total consumption in the Czech Republic. This excess energy production will have to be reflected in the price. It will be either nuclear or green, which will be much more expensive. Logistics costs are likely to increase. All in all, the impact could be hundreds of euros per tonne of steel.

And if we consider that longer-lasting, higher-quality steel will come back into circulation later and that scrap will therefore generally become scarcer, the route of producing steel in electric arc furnaces from scrap is not the only possible solution either. It is only one way. A mix of production technologies is therefore likely. Given that there are about 4.5 million tonnes of scrap in the country, I think we will go down the electric arc furnace and hybrid furnace route in this country.

More than competitiveness, I think it will be a question of how each country approaches the promotion of emission reduction projects and sets reasonable milestones for moving away from fossil fuels. Steel will one day be green, but it will not be cheaper and we will all have to pay for cleanliness.