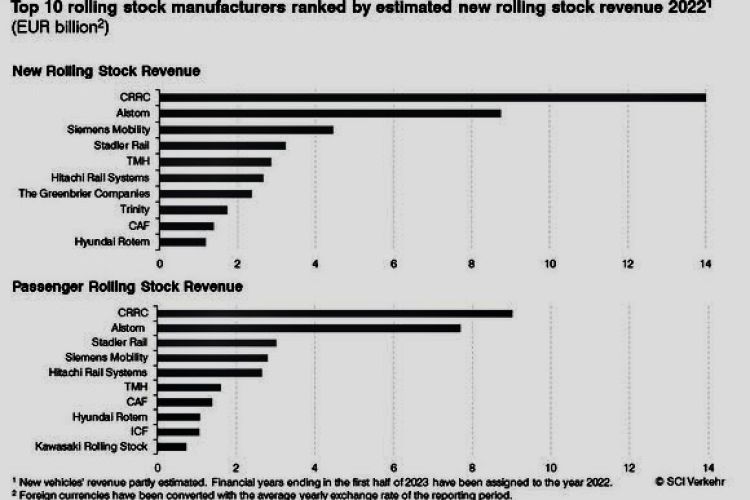

This is 5% higher than the previous year's figure of EUR 53.9 billion and also higher than the figure for 2019, the last year of growth before the COVID 19 crisis. The top 10 manufacturers accounted for 75% of sales. In total, eleven vehicle manufacturers achieved new vehicle sales of more than EUR 1 billion each in 2022, and five other manufacturers achieved new vehicle sales of more than EUR 500 million each.

There were only minor changes in the top ten rolling stock manufacturers in 2022 compared to the last study published by SCI Verkehr (2021). Due to the merger of Alstom and Bombardier in January 2021, Siemens now ranks third, followed by Stadler Rail in fourth place. TMH, the largest manufacturer from Russia, remains in fifth place, while Hitachi Rail and The Greenbrier Companies each move up one place. US freight car manufacturer Trinity Rail returns to the podium after a year's absence, ousting India's Integral Coach Factory (ICF). Hyundai Rotem enters the top 10 for the first time, following Spanish manufacturer CAF.

Passenger coaches account for the largest share of sales worldwide. Within this segment, Stadler is the third largest manufacturer behind CRRC and Alstom, ahead of Siemens Mobility and Hitachi Rail Systems. Other players in the top 10 passenger car manufacturers include Russia's TMH, CAF, Hyundai Rotem, Integral Coach Factory and Kawasaki Rolling Stock.

The industry has successfully consolidated itself, with a total turnover of 56.8 billion euros in new rolling stock, following the solid years of pandemic, war and inflation. Many manufacturers were able to catch up on production backlogs and fulfil existing contracts. As a result, growth in the rail vehicle market reached the 5% mark last year and is back above the 2019 figure for the first time. After a decline of 4% in 2020 and a slight recovery of 2% in 2021, SCI Verkehr expects very stable growth in the future. It is worth noting that the concentration of sales among the top 10 manufacturers has increased and will reach 75% in 2022, led by the two heavyweights CRRC and Alstom.