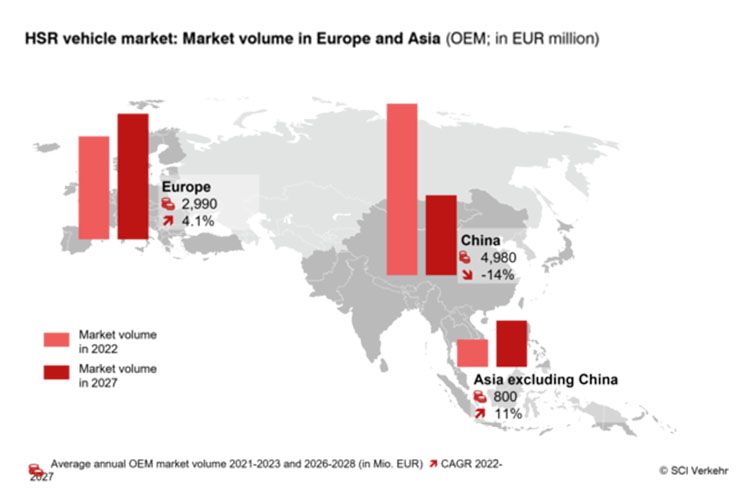

Asia and Europe also accounted for 95% of the global market volume over the last five years. Despite their common omnipresence, the two markets are developing very differently. While SCI Verkehr expects moderate annual growth of 4% for the European market over the next five years, the Asian market will decline after the extreme Chinese delivery peaks of recent years.

The Asian market

The after-sales market in particular will grow strongly in the coming years due to the ever larger and at the same time ageing fleet. This is the conclusion of the latest multi-client study "High-Speed Rail Transport - Global Market Trends 2023", in which SCI Verkehr analyses the individual developments in high-speed rail transport in the various market regions.

Since 2003, a huge high-speed rail network has been built in China. The national high-speed network will exceed 40,000 km in 2021. By 2035, the Chinese government plans to have a network of 70,000 km, connecting all 300 cities with more than 500,000 inhabitants. In the medium term, however, the strong growth in China's transport performance will slow down as the pace of network expansion slows, the population declines slightly, urbanisation stagnates and the newly connected routes do not offer as much potential as the initial routes. Nevertheless, SCI Verkehr still sees potential for further growth, albeit at a comparatively slower pace. This is due to the fact that the Chinese middle class, which is the main customer group for HGVs, especially on longer routes, is expected to continue growing. According to the World Bank, the middle class could account for around 70% of the Chinese population by 2030. In addition, the Chinese government is placing increasing emphasis on environmental concerns and could regulate China's domestic aviation market. Rising fuel prices could also further boost demand for Chinese HSR services. Beyond the established markets of China, Japan and Korea, new markets entering the HSR sector in the medium term include Indonesia, Thailand and India. In the longer term, others such as Vietnam could follow.

The European situation

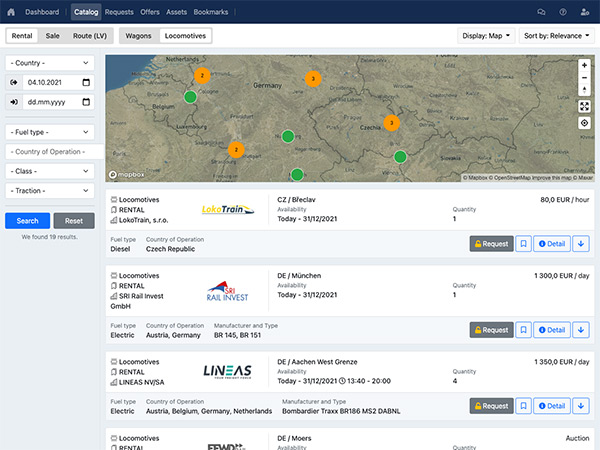

In contrast to Asia, where the operator landscape is dominated by state railways and driven by infrastructure development, Europe is the first market region where direct competition between new and incumbent operators (usually a former state railway) is emerging in the HSR segment. The most notable cases of private open access operators in the high-speed sector in Europe include NTV (Italo) in Italy since 2012 and, more recently, Iryo, which launched HSR services in Spain at the end of 2022.

In addition, more and more incumbent operators in Europe are offering selected routes in direct competition. Faced with increasing competitive pressure, European incumbents are reducing cross-border cooperation on their HSR services and expanding into other European countries through subsidiaries. Trenitalia, which will operate its own services between Milan and Paris from 2022, is a direct competitor of SNCF on the French domestic market. SNCF is participating in the liberalisation of the Spanish HSR market and will offer services in Spain under its low-cost OuiGo concept from 2021. Between other national markets, such as between France and Germany, binational cooperation still prevails, as long as greater competition is not reinforced by regulation. Although all long-distance passenger transport markets, including HSR markets in the EU, are open to competition, barriers to competition and liberalisation remain, such as high procurement risks, high track access charges, network capacity bottlenecks and existing incumbent monopolies (e.g. for ticketing and sales).