Despite challenges such as the Corona crisis and the war in Ukraine, rail freight transport has shown modest growth of 0.6% per year since 2017. SCI Verkehr forecasts an average growth rate of 1.6% per year until 2027.

One notable trend is the strategic acquisition of rail logistics assets by major shipping companies. For example, MSC (Mediterranean Shipping Company) has built up an extensive intermodal network, and CMA CGM has acquired Gefco, a company specialising in the transport of cars, with the aim of becoming the world leader in automotive logistics. APM-Maersk has also entered the rail sector by establishing a new combined transport link between China and Europe via the New Silk Road Central Corridor, integrating rail freight with maritime transport.

The conflict in Ukraine has necessitated a reorganisation of East-West transport since 2022, resulting in a decline in rail freight traffic in the Baltic States and Finland, as well as a reduction in transit traffic to and from the EU's North Sea and Baltic Sea ports. In addition, Russia's attractiveness as a transit country for European hauliers has decreased, leading to an increasing share of goods being transported via the central corridor of the New Silk Road.

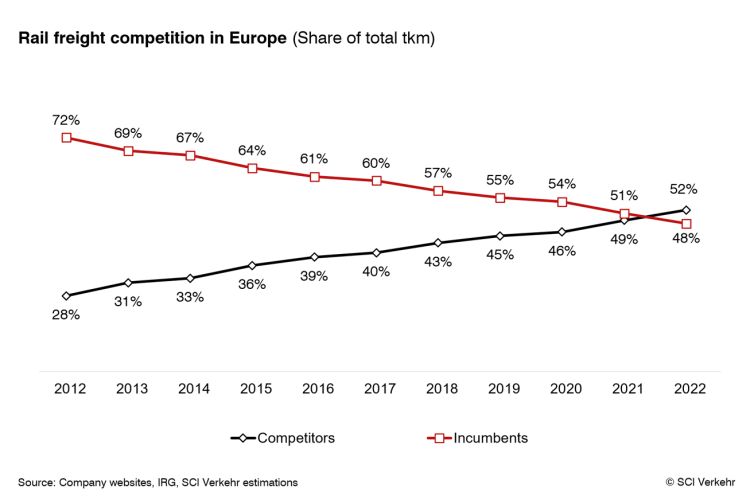

Despite political declarations of intent, rail freight in Europe remains unprofitable for many players, partly due to uneven competition with road transport. In addition, competition within rail is increasing, with former state railways losing market share to competitors, often subsidiaries of foreign state railways.

The EU Commission is closely monitoring the competitive situation between the former state railways and their competitors. In particular, state aid proceedings have been opened against Fret SNCF and DB Cargo, with Fret SNCF facing a break-up and the transfer of traffic to competing operators. The outcome of the case against DB Cargo is still pending.