The war in Ukraine was one of the major factors changing European railway routes over the recent period. How did it affect your business?

Every change in the market is an opportunity at the same time. The transport routes have changed significantly, whether it is gas now going from the west to the east, grain from the east to the west, or even military transports themselves. Another factor we need to observe almost daily is the sanctions, whether some companies have Russian capital and if they were added to the sanction lists. For example, we had 20 wagons loaded, and everything was suddenly frozen due to sanctions from one day to another.

And on top of that, there was the energy crisis.

Yes, and that is closely related to Ukraine. If the energy prices rise, European manufacturers stop being competitive in global markets. And they stop moving goods too. We have lost customers, who were not competitive with their production facilities as importing products made in China, including transport, was still cheaper. I hope we will not face further de-industrialisation in Europe.

Which commodities dropped, and which rose the most?

I have mentioned the commodities which rose – grain westwards and gas eastwards. The question is, which ones will stay and which ones will be temporary? If 60% of grain declared for transit through Europe stayed in Europe, some countries have, naturally, stood against it to protect their domestic farmers. We expect the gases to shift permanently and be imported to Ukraine from Western Europe. Another, maybe temporary, was the coal transport, which has risen considerably. We have seen no big changes in consumer goods, which we mostly move from Western Europe to Scandinavia. But steel went down, and petrochemicals too. That is related to the factor of these days, when some countries, like India in petrochemicals or China in steel, can make it so cheaply that logistics for 10 000 km wins over logistics for 500 km.

Fret SNCF has recently announced a significant restructuring, forced by the EU that evaluated its support by the French government as not compliant. How will it affect your business and customers, mainly in the wagonload business?

Wagonloads should not be impacted by the restructuring at all. The most significant change is that twenty train lines, mostly intermodal, need to be re-tendered, but that does not affect single wagonloads. There is no need for worries. Business of Forwardis with our European partners stays as usual.

An interesting feature of Forwardis business is that you also organise waste shipments. Is this a commodity you see as the potential growth for the rail business?

Waste, in general, is a great potential. We, as humans, need to use it more smartly. Produce less of it, and what remains, we need to recycle or utilise differently. We have a case study in France when using special equipment and containers for recycling logistics. Then we also move waste from Spain to Scandinavia for thermal utilisation. So, waste and recycling is a massive opportunity for rail that we need to grab it and use it in favour of railway transport.

To what extent is your business affected by the often uncoordinated infrastructure projects in European countries?

On railways, there is always something going on. A driver shortage. A locomotive shortage. Lots of construction work… I do not understand why it cannot be better coordinated across Europe, and several lines are closed simultaneously. When there is a shift of route needed, on the one hand, you need to recalculate whether the diversion can still be profitable. On the other hand, when option one is closed, everyone reaches for the second-best option – which is much pressure on infrastructure. Longer routes mean longer delivery times, more drivers needed, slower turnover of wagons… so we need to react, react and react.

So, do the most flexible ones survive?

Flexibility is within the DNA of this business. People might take it as something special from the outside, but once you are in this business for a few years, you start to take it as normal. It is even hard to clearly envision where you want to go now that everything changes quickly. So, we focus on flexibility and reacting swiftly and efficiently to whatever railway logistics life throws at us.

Women in this business are still uncommon sight, unfortunately. How did you manage to make it so high up in this business?

In 2007, I got the opportunity to get a glimpse of the logistics at Ermefret; I liked it and stayed. What I like about railway logistics is the great people I meet. In Europe, it is rare to meet people who started at the bottom of the hierarchy and reached the very top. But in railways, you do. And the people who know the business from the bottom to the top are always nice, humble, and great to talk to.

Personally, I like the very basics of logistics. I like calculating and looking at things from different perspectives, recalculating and combining. As society evolves, as times change, it is all reflected in logistics, and if you can efficiently respond to that, you have won. Closing a deal is more straightforward than managing it, especially if you are in a position where you manage other people.

So, what’s the recipe for success in railway logistics in a nutshell?

You must like it, and you must work hard. It’s that simple.

Is there something in railways you see as things with great potential?

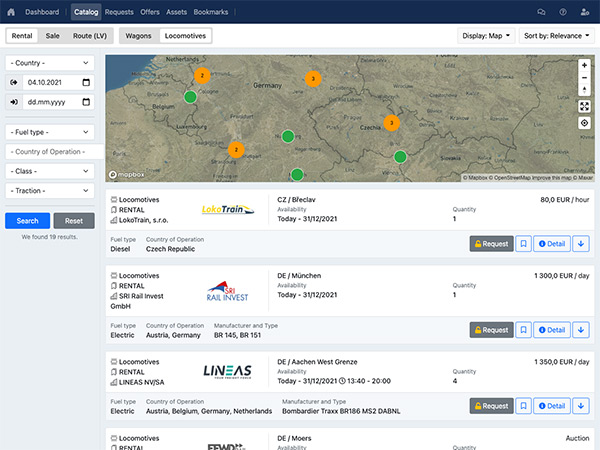

Much is being said about digitalisation, which is a way to go. Whether it is locomotives communicating with infrastructure, digital platforms like your Railvis, or even autonomous trains - these things are all here to make our lives easier. Then it is our role to use the time we save by their usage for our self-development and self-improvement.

In your view, what do we need for more goods to start shifting to rail?

Strong lobby and robust infrastructure. Even if we would shift more to rail, there needs to be more rails to cope with the wanted growth at the moment. We need to make railways simpler and easier to use. That’s why the combination of rail and road is so good. Customers need to benefit from both – the last mile flexibility of road and the efficiency and ecology of rail in the long run. In some shipments, when sidings are on both sides of the route and transports are regular, railways are by far the best option in all terms. But the railway sidings infrastructure rather vanishes than flourishes. That needs to change.

And there are many irregular shipments where people demand speed: online purchases, the next-day deliveries. One needs to ask - do we really need it that fast? Or shall we have an option for slower, more ecological transport to our doorstep? As life goes more quickly every year, we all need to make smarter and more responsible decisions. In a certain way, railways are still dinosaurs. Not in terms of extinction, quite the opposite. But in terms of size. That is hard to change. But our role is to make railways a sexier dinosaur.