Ports, terminals and rail operators are highly attractive to global logistics players, especially in times of crisis.

Whereas in the past the market was defined by the market shares of individual players at regional and national level, in the future decision-makers will have to consider the organisation and control of global transport chains. A prime example is the assessment of MSC's investment in Hamburger Hafen und Logistik AG (HHLA) and subsequently in the company's rail operator, Metrans.

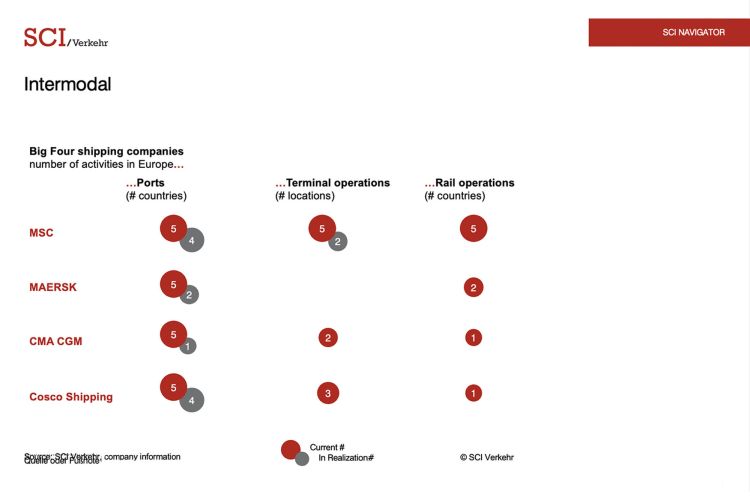

By analysing the entire European intermodal market, SCI Verkehr examines in detail the activities of of a small group of globally active companies that shape supply and transport chains step by step according to their The Big Four intermodal service providers: MSC, MAERSK, CMA CGM and COSCO.

With high purchasing power, these global players can buy partnerships, shares and entire companies along the supply chain. With each acquisition of ports, hinterland terminals, rail and, increasingly, road operators, their influence grows. Service networks guarantee flexibility within their own networks: Volumes, routes and combinations of transport modes in can be determined independently of suppliers and competitors.

The growing power of the Big Four has the potential to reshape the competitive framework of the rail and logistics sector. With unfettered influence over supply and transport chains, their own strategic objectives dominate and become increasingly independent of political regulation. Neither national nor European policy objectives - such as climate change, mobility and the connectivity of peripheral regions - are the main drivers for the well-connected large companies, but the control of European import and export flows, which guarantee profits for each player.

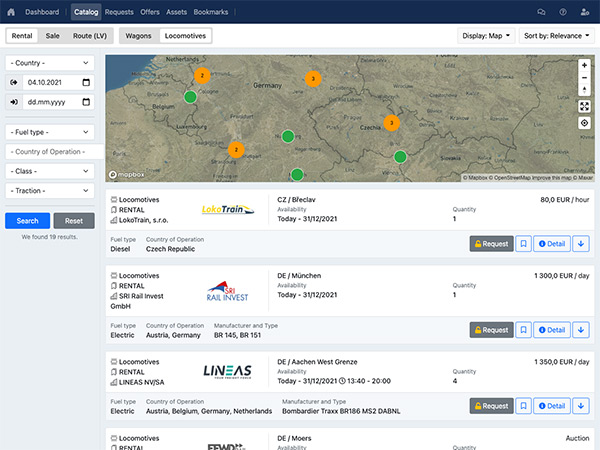

The European competition authorities (EC) are also increasingly concerned to ensure a level playing field in rail freight transport, especially with regard to the (former) national incumbents. While the EC's investigations open up space for competitors, this space is also of interest to the biggest players. This is also driven by high investment needs: Aging rolling stock on infrastructure that is operating at capacity is coupled with low growth rates and unbalanced competitiveness.

Under these circumstances, all stakeholders need to have a clear vision of the European intermodal market: The key factors - such as access to ports, terminals and railways and the availability of corridors - are the focus of this study by SCI Verkehr.