Minerals, agricultural products, and exactly coal account for the bulk of total rail freight activity. Based on current market trends, the International Energy Agency (IEA) report forecasts that coal consumption will then remain at this level until 2025, as declines in mature markets are offset by continued robust demand in emerging Asia.

The world's three largest coal producers - China, India and Indonesia - have all set production records. Emerging and developing economies in Asia will increase their use of coal to power their economic growth in the coming years, even as they increase their use of renewable energy. Developments in China, the world's largest coal consumer, will have the biggest impact on global coal demand in the coming years, but India will also be important.

According to one of the IEA's earlier studies, rail freight in this Asian country has increased by 150% in the last 20 years. And this study also forecasts, in two scenarios, the development of rail freight around the world over the next few decades. Minerals, coal, and agricultural products account for the bulk of total freight rail activity.

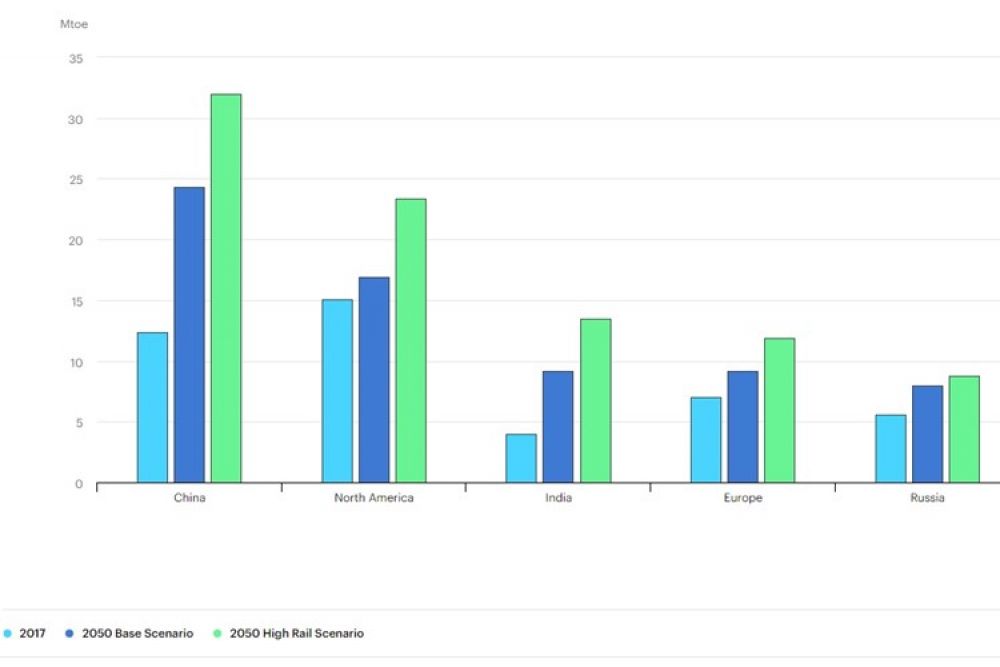

Base Rail Freight Scenario

Although rail freight (like all other freight movements) has historically been positively correlated with economic growth, the degree of correlation varies widely and will not necessarily continue in the future. The various influences at work include geography, policy and the investment climate (as well as the relative priority given to rail freight compared to passenger transport). The increasing demand for flexibility means that the successful integration of rail freight services into the overall freight transport system will be a criterion for the success of rail freight in the future. In the baseline scenario, rail freight is expected to grow at rates closely linked to economic growth in those countries where it already has a large share of freight movements, such as Russia, China, the United States and India. Overall, although rail freight activity doubles to more than 20 trillion tonne-kilometres by 2050, growth in activity in other modes (road and water) outstrips that of rail, so that rail's share of total freight activity falls from 7% of all tonne-kilometres in 2017 to 5% in 2050.

High Rail Freight Scenario

Freight rail in this scenario increases by 3 trillion tonne-kilometers in 2050 compared to the Base Scenario, despite an overall decrease in freight activity of 5%, due to structural changes in the supply chain and general improvements in logistics. This change, driven by pricing policies, investments in intermodal terminals, and better integration of rail in supply chains, is mainly driven by a shift from heavy road freight to rail. Increased rail capacity allows the rail to maintain its market share in the transport of bulk commodities, to broaden the range of commodities carried (e.g. by increasing the share of fertilizers, agricultural products, and intermediate manufactured goods), and to capture some of the overland transport of containers. China, North America, Russia, and India account for most of the net increase - regions with significant inland freight movements, large shares of rail freight, and where road freight movements by heavy vehicles are large enough to justify a modal shift.

In the High Rail Freight scenario, the share of rail freight in total freight transport (excluding shipping) remains stable at around 27% in 2050, while in the Base scenario, this share falls from 28% in 2017 to 23% in 2050. In principle, rail freight could gain additional market share from long-distance maritime transport, but such a development is not taken into account in the High Rail Scenario.